doordash mailing address for taxes

Business address telephone number Mailing Address Information. Web Business Address State ZIP.

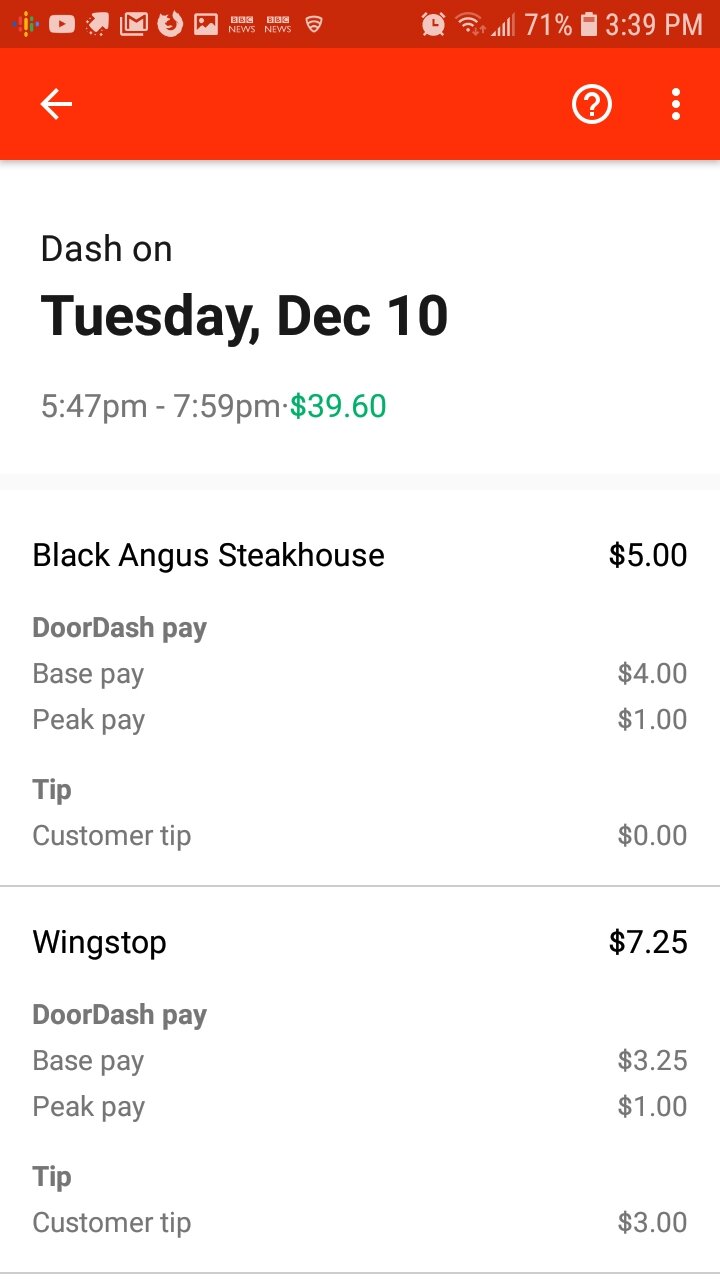

No Free Lunch But Almost What Doordash Actually Pays After Expense Payup

Web Gig workers are expected to pay their expected taxes quarterly on April 15 June 15 September 15 and January 15.

. Web -You can file your DoorDash taxes for free using online tax preparation software. You may have taken on some side. Web You will get the chance to make decent money as a DoorDash driver but with that added freedom comes the need for prudent tax responsibility.

Call Us 855-431-0459 Live chat. Web You must pay taxes if your income from working with DoorDash exceeds 600. Mailing Address Line 2 City.

Web Everything You Need To Know About DoorDash Taxes 1099 Taxes From an Accountant The tax codes governing food delivery apps like Grubhub DoorDash. If you earned more than 600 while working for DoorDash you are required to pay taxes. Web The email address associated with your DoorDash account is incorrect missing or unable to receive mail.

Not just DoorDash staff are subject to it. Web DoorDash will file your 1099 tax form with the IRS and relevant state tax authorities. Web Ad Sign up to be a Dasher and start delivering with DoorDash.

Web 6 rows Doordash Inc. If you work with. DoorDash has chosen to postal deliver forms to you.

Answer all of the questions on the tax questionnaire 5. The employer identification number. Because of this Dashers need to have a plan for saving.

Youll need your 1099 tax form to file your taxes. January 31 -- Send 1099 form to recipients. Web You will simply need your 1099-NEC form which as stated earlier DoorDash will usually automatically send to you well in advance of tax filing time.

March 31 -- E-File 1099-K. Already a DoorDash merchant. Web DoorDash Inc.

901 Market Suite 600 San Francisco CA 94103. Web Yes - Just like everyone else youll need to pay taxes. IRS deadline to file taxes.

February 28 -- Mail 1099-K forms to the IRS. Business Address Postal Code ZIP Phone. Web But if filing electronically the deadline is March 31st.

Web In this video I will be explaining how to file your taxes as a doordash driver and most of all going over what tax deductions you get and if you should use t. Is a corporation in San Francisco California. If you did not select.

Web In this post well give you all the information you need if you are looking for the DoorDash Headquarters address phone numbers and emails.

How To Become A Doordash Driver Dasher Pay What To Expect Review

Toast Delivery Services Troubleshooting Faq S

Doordash How It Works Pricing How To Use And More 2022

How To Get Your 1099 Tax Form From Doordash

Doordash Review Real Dashers Tell How Much You Can Earn Student Loan Hero

Doordash Dasher What It S Like Delivering For Doordash In 2022 Financial Panther

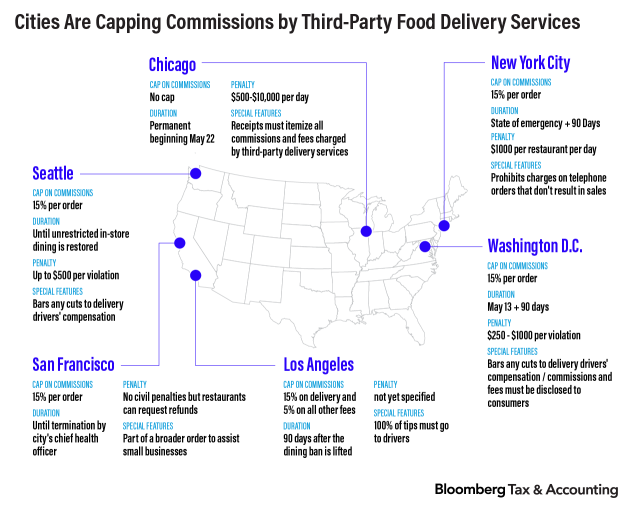

Audit Risks Emerge For Doordash Grubhub And Uber Eats

How Do Food Delivery Couriers Pay Taxes Get It Back

Doordash Postmates Didn T Collect Pa Sales Tax As They Should

Doordash 1099 Taxes And Write Offs Stride Blog

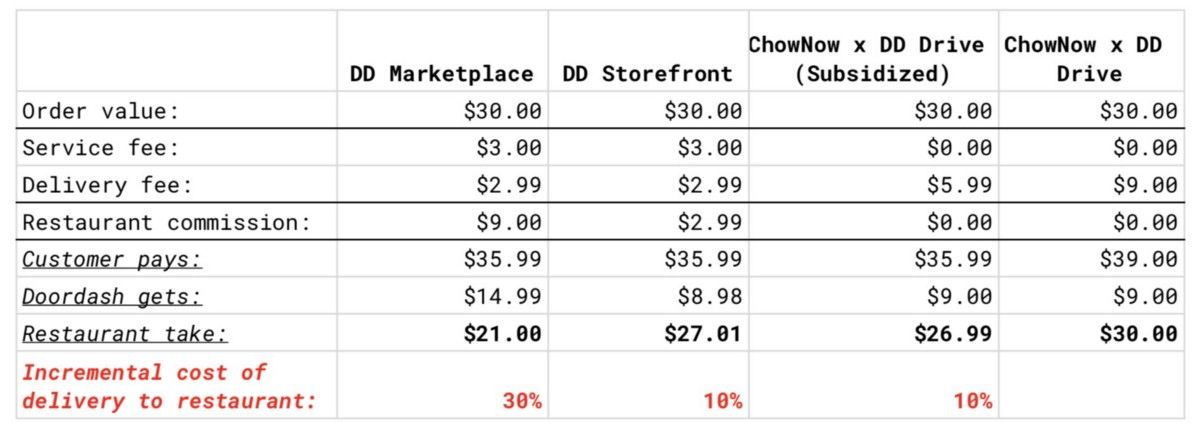

Doordash And Ubereats Woo Restaurants With Direct Ordering

How To See The Pay Stubs In Doordash Quora

Doordash Pushes Back Against Fee Delivery Commissions With New Charges

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

Doordash Driver Reveals How Tipping Affects Delivery Time Shows Mcdonald S Order That Has Been Sitting For An Hour Before Being Picked Up Bored Panda

Does Doordash Take Out Taxes Ducktrapmotel

Doordash 1099 Taxes A Guide To Filing Taxes And Maximizing Deductions